ITIN Renewal Services

If your Individual Taxpayer Identification Number (ITIN) is about to expire, the tax professionals at Gibson Tax Accounting can help you renew it seamlessly so you can continue filing taxes.

Why Renew your ITIN?

ITINs that have not been used on a federal tax return within the last three years will expire. In addition, all ITINs issued before 2013 will expire at the end of 2023. Having an expired ITIN can cause issues such as:

- Delays in processing your tax return.

- Denials of Tax Treaty benefits

- Denial of dependent exemptions.

- Denials of certain credits, such as the Child Tax Credit

As your local tax accountant, Gibson Tax Accounting keeps up with the most recent IRS regulations for ITIN renewal to ensure that your filing eligibility and refunds are not jeopardized.

ITIN Renewal Support

Our accounting firm offers comprehensive assistance in completing your ITIN renewal application, including:

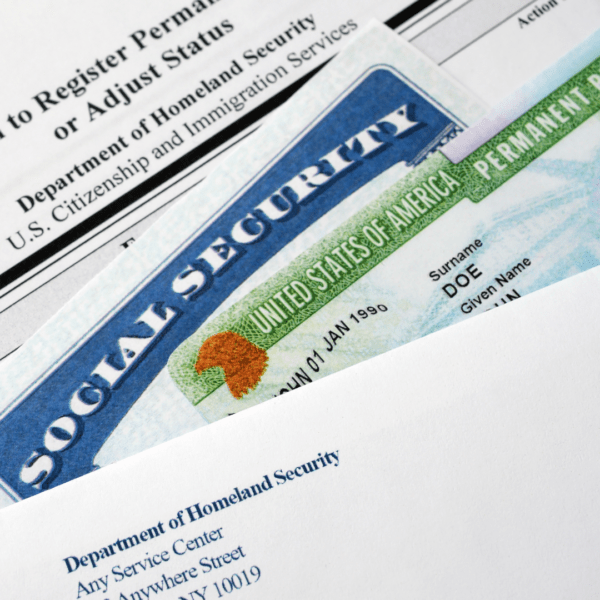

- Guidance for gathering the necessary renewal documentation

- Checking that your application materials are correctly filled out.

- Attach the necessary tax forms and identification documents.

- Sending your renewal application via certified mail.

We also follow up with the IRS to resolve any issues that arise during the renewal processing and verification.

Contact us right away to ensure that your ITIN does not lapse, jeopardizing your tax status in the future. A free consultation is just around the corner.